Kredin: Automated Debt Collection Enhances Cash Flow Efficiency

Successive Digital built Kredin, an intelligent cloud-based debt collection system that automates payment reminders and streamlines credit collections, resulting in improved cash flow and operational efficiency.

At a glance

Finance

Norway

Successive Highlight

80% Increase in Debt Recovery Rate:

Our solution boosted debt recovery by 80% through automated reminders and streamlined collection workflows.

65% Increase in Debt Collection Rate:

Enhanced communication and automated processes raised overall debt collection efficiency by 65%.

Client & Business Challenges

Kredin, a leading provider of cloud-based debt collection solutions, faced significant challenges with manual debt recovery processes. Creditors spent excessive hours chasing payments, leading to delayed cash flow and increased operational costs. The outdated, disjointed systems hindered real-time monitoring and created reliance on third-party agents, resulting in inefficiencies and poor customer satisfaction. The client needed a modern, automated platform to streamline credit collections, reduce manual intervention, and deliver real-time, actionable insights for better cash flow management, thereby ensuring timely debt recovery and enhanced overall operational performance.

The Solution

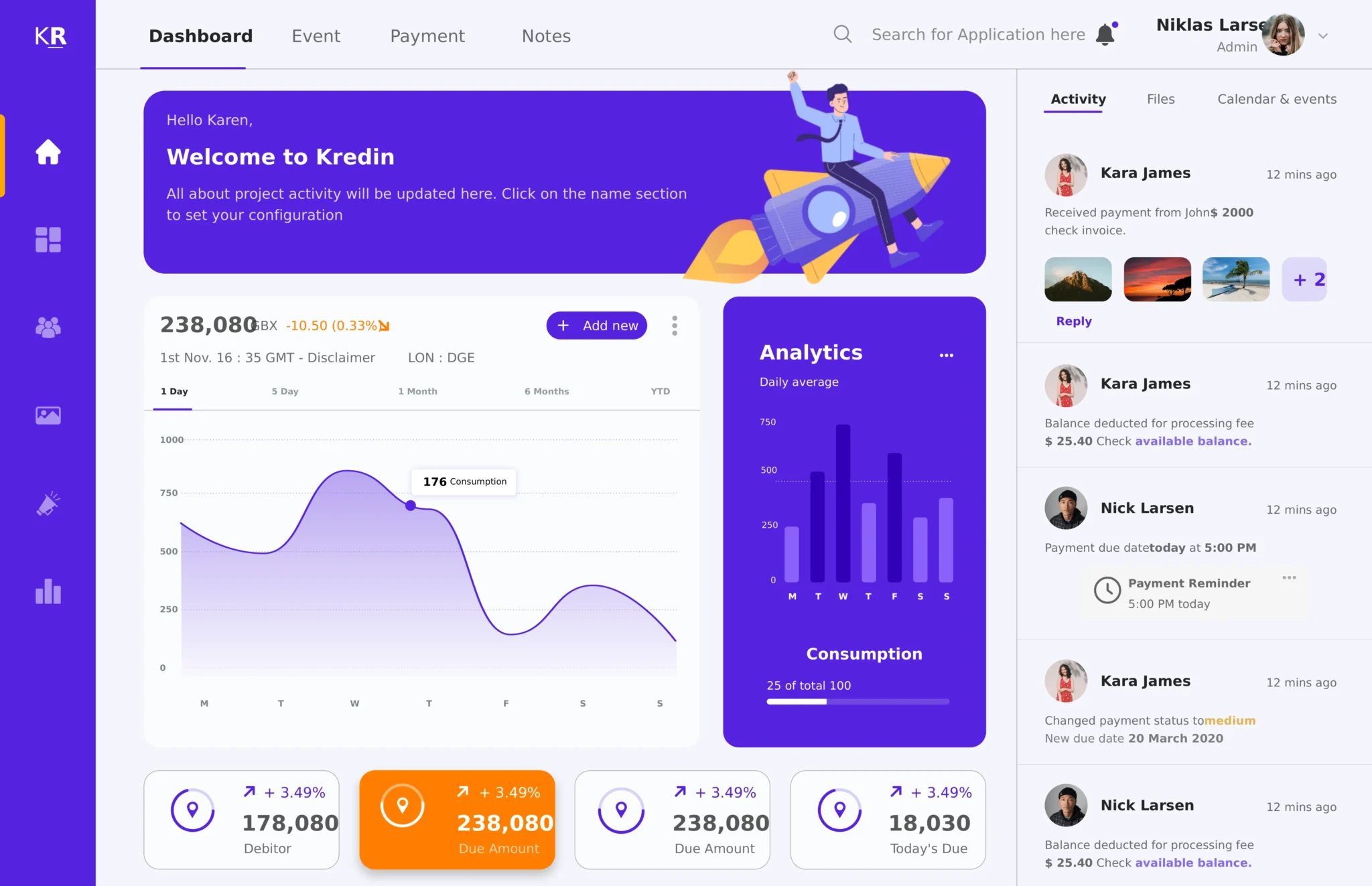

Successive Digital partnered with Kredin to develop a comprehensive fintech solution that automates debt collection and enhances cash flow management. We implemented an integrated platform with a responsive front-end—crafted using HTML, jQuery, CSS, and secure payment integration with Stripe—and a robust back-end developed using PHP, CodeIgniter, and Composer. The system features automated payment reminders, real-time reporting dashboards, and customizable charts powered by Highcharts. This end-to-end solution streamlined manual workflows, reduced dependency on debt collection agents, and provided creditors with real-time access to critical data, thereby significantly improving operational efficiency and customer satisfaction.

- Responsive Front-End

We designed a dynamic, user-friendly interface using HTML, jQuery, and CSS, which delivers real-time notifications and automated payment reminders. The intuitive dashboard allows creditors to easily monitor payment statuses, view customizable charts, and manage debtor interactions—greatly reducing the need for manual follow-ups and improving the overall user experience.

- Robust Back-End Architecture

Utilizing PHP, CodeIgniter, and Composer, we re-engineered the back-end to support rapid data processing and secure transactions. This architecture facilitates real-time reporting and automated workflows while seamlessly integrating with third-party tools like Highcharts. The robust system ensures accurate data handling, reduces processing delays, and optimizes overall debt recovery management.

- Automated Reporting & Analytics

Our solution integrates advanced reporting features using Highcharts for dynamic, customizable data visualization. Automated dashboards provide real-time insights into cash flow, payment trends, and collection rates. These analytics empower creditors to make informed, strategic decisions, optimize their collection processes, and reduce operational costs through data-driven improvements.

Results Accomplished

Kredin’s automated debt collection solution revolutionized recovery processes, increasing efficiency, reducing costs, and providing real-time actionable insights.

Enhanced Recovery Rate

Improved Collection Efficiency

Cost Reduction

Real-Time Insights

.jpeg)

Successive Advantage

We design solutions that bring unmatchable customer experience to life and help companies accelerate their growth agendas with breakthrough innovation.

Connect with us